Which Best Describes What a Central Bank Uses Monetary Policy

The central government uses monetary policy to complement other economic policies. To do that they can resort to three main monetary policy tools.

The Benefits And Costs Of A Central Bank Digital Currency For Monetary Policy Bank Policy Institute

Here are the four primary tools and how they work together to sustain healthy economic growth.

. A central bank may deploy an expansionist monetary policy to reduce unemployment and boost growth during hard economic times. Ensure that the government is sufficiently funded. Steer the economy away from recession and toward growth The___ rate is the interest rate banks charge each other for borrowing or storing money.

Which best describes what a central bank uses monetary policy to do. Contractionary monetary policy is when a central bank uses its monetary policy tools to fight inflation. Which statement best describes monetary policy.

Central banks have four main monetary policy tools. If things arent going wellunemployment is high growth is lowthen more money flowing around the economy makes it easier for people to get loans to make big investments which helps the economy get going again. Open market operations the discount rate and reserve requirements.

Ensure that the government has a balanced budget. Normally central banks only transact with commercial banks. Governments typically use fiscal policy to promote strong and sustainable growth and reduce poverty.

One of their main focuses is monetary policy ie. It affects banks stability. The reserve requirement open market operations the discount rate and interest on reserves.

Ensure that the government has a balanced budget Influence financial institutions globally Ensure that the government is sufficiently funded Steer the economy away from recession and toward growth. The government uses tools such as the repo rate and reserve requirement in carrying out monetary policy. Monetary policy is necessary to control inflation and ensure the stability of the financial system.

If inflation threatens the central bank uses contractionary monetary policy to reduce the supply of money reduce the quantity of loans raise interest rates and shift aggregate. It affects banks liquidity. Bank Rate Variation Policies.

The bank will raise interest rates to make lending more expensive. Its how the bank slows economic growth. The three main tools central banks use to implement monetary policies are discussed below.

Government spending and taxes are used as tools of monetary policy to. Central banks have four main monetary policy tools. Inflation is a sign of an overheated economy.

The regulation of money supply within a nations economy. This is often contrasted with the fiscal policy of a country. It affects banks lending practices.

This is called expansionary or loose monetary policy. Central banks control the money supply in the economy through monetary policy. Ensure that the government has a balanced budgetO influence financial institutions globallyO ensure that the government is sufficiently fundedsteer the economy away from recession and toward growth.

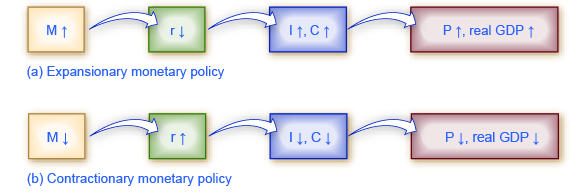

Fiscal policy is the use of government spending and taxation to influence the economy. Which best describes what a central bank uses monetary policy to do. Expansionary monetary policy is when a central bank uses its tools to stimulate the economy.

Open market operations are a means to control the money supply by buying or selling bonds on the open market using newly created money. The government uses tools such as the repo rate and reserve requirement in carrying out monetary policy. For instance a central bank may reduce the amount of money by selling government bonds under a sale and repurchase agreement thereby taking in money from commercial banks.

Monetary policy refers to tools used by central bank to influence economic activity. The reserve requirement open market operations the discount rate and interest on reserves. Central Banks and Monetary Policy.

Monetary policy is a policy that a central bank of a country used to effects the economy is some way by controlling the money flow. Central banks conduct monetary policy by adjusting the supply of money generally through open market operations. D steer the economy away from recession and toward growth best describe what central bank uses money policy to do.

What is supply and demand and why is it important. Central banks are typically in charge of monetary policy. Which best describes what a central bank uses monetary policy to do.

Interest rate is the tool central banks mostly use to express their policy intentions to commercial banks the entire financial system and the economy in general. Which best describes what a central bank uses monetary policy to do. Supply and demand are both important for the economy because they impact the prices of consumer goods and services within an economy.

Does expansionary policy increase demand. Which best describes what a central bank uses monetary policy to do. The central government uses monetary policy to complement other economic policies.

Whenever the money supply is increased in a country inflation also rises because the competition among the people increases to avail goods and services. Growing inflation could lead to an increase in interest rates or a decline in the money supply which is usually regarded as a contractionary monetary policy. A central bank today primarily uses inflation targeting to keep its growth rates stable and prices reasonable.

That increases the money supply lowers interest rates and increases demand. Central banks are independent national institutions that provide financial and banking services. The role and objectives of fiscal policy gained prominence during the recent global economic crisis when governments stepped in to support financial systems.

Monetary policy refers to tools used by central bank to influence economic activity. If inflation threatens the central bank uses contractionary monetary policy to reduce the supply of money reduce the quantity of loans raise interest rates and shift aggregate demand to the left. Influence financial institutions globally.

Most central banks also have a lot more tools at their disposal. It affects banks interest rates. Its also called a restrictive monetary policy because it restricts liquidity.

A key role of the central banks is to conduct monetary policy so as to achieve price stability low and stable.

Lesson Summary Monetary Policy Article Khan Academy

Economic Lowdown Video Series Economics Lessons High School Lessons Education

Kate Judge Profkatejudge Twitter

The Hutchins Center Explains The Phillips Curve

Money Creation In A Fractional Reserve Banking System The Simplified Cartoon Version Money Creation Monetary Policy Economics Project

:max_bytes(150000):strip_icc()/dotdash_Final_WhatDo_the_Federal_Reserve_Banks_Do_May_2020-01-08af2fa345a440ff9df4c83495ad4328.jpg)

What Do The Federal Reserve Banks Do

What Is Monetary Policy How Does It Work Forbes Advisor

Monetary Policy The Federal Reserve Quiz Flashcards Quizlet

Macro Ch 17 Flashcards Quizlet

Words Versus Deeds How Central Banks Manage Expectations Vox Cepr Policy Portal

The Fed Monetary Policy Monetary Policy Report

The Fed Monetary Policy Monetary Policy Report

Lesson Summary Monetary Policy Article Khan Academy

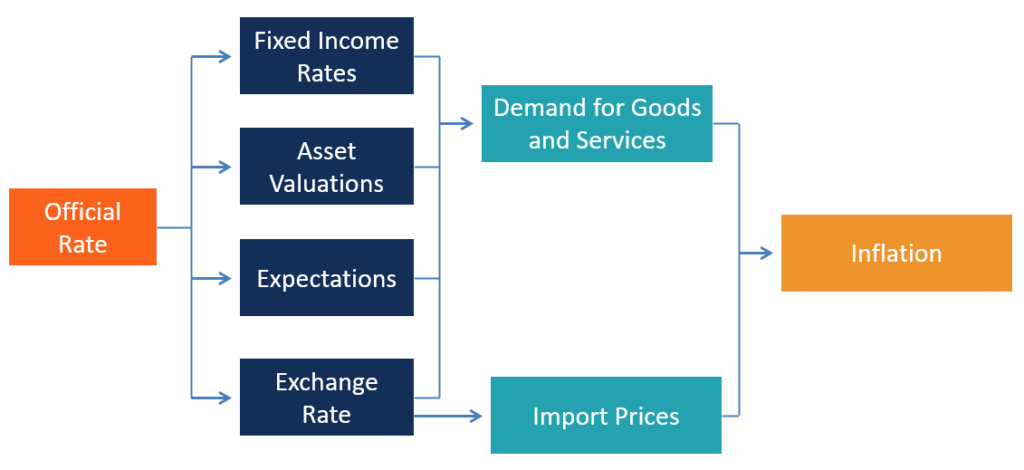

Monetary Transmission Mechanism Overview Central Bank Action

The Fed Monetary Policy Monetary Policy Report

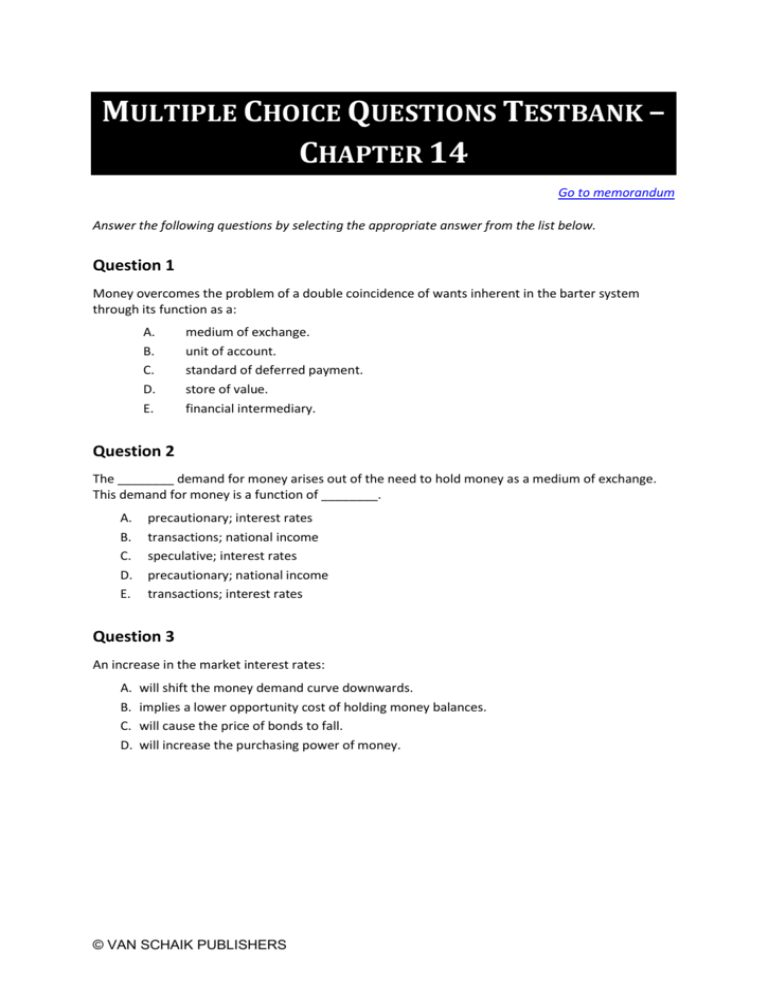

Multiple Choice Questions Testbank Chapter 14 Go To Memor

Central Bank Independence A Rigged Debate Based On False Politics And Economics

28 4 Monetary Policy And Economic Outcomes Principles Of Economics

/36960441942_933c962a43_k-7bef3f0503ae4eb4ade5b9e86f9a5e58.jpg)

Comments

Post a Comment